DeFi Saver

DeFi management dashboard with automation and risk management features

Introduction

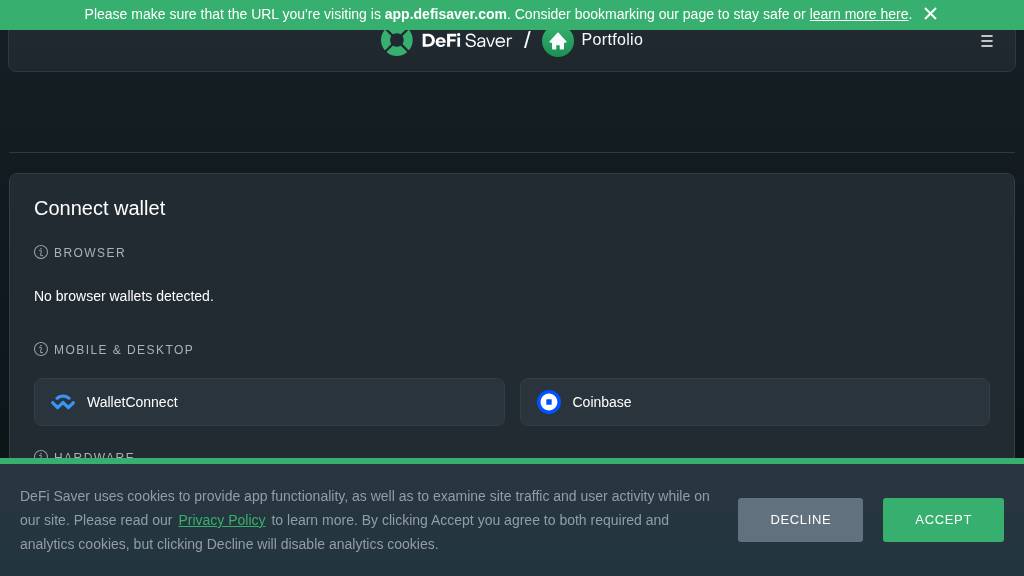

What is DeFi Saver

DeFi Saver is a decentralized finance management and automation platform built on Ethereum. It serves as a one-stop solution for managing various DeFi positions across multiple protocols. The platform combines advanced features like automated position management, leverage adjustment, and liquidation protection with an intuitive interface. It primarily focuses on lending protocols such as MakerDAO, Aave, and Compound, allowing users to monitor and manage their positions, adjust collateralization ratios, and implement automated strategies. The platform utilizes smart contracts for secure execution of transactions and provides real-time monitoring of DeFi positions.

Main Features

1. Smart Contract Automation: Automated position management and liquidation protection

2. Multi-Protocol Support: Integration with major DeFi protocols like Maker, Aave, and Compound

3. Position Management: Tools for monitoring and adjusting collateralization ratios

4. Leverage Management: Features for adjusting leverage across different protocols

5. Recipe Creator: Custom automation strategy builder

6. Real-time Monitoring: Dashboard for tracking positions and market conditions

7. Flash Loan Integration: Efficient position management using flash loans

8. Gas Cost Optimization: Smart transaction routing for better gas efficiency

Use Cases

1. Liquidation Protection: Automatically maintain safe collateralization ratios

2. Leverage Management: Adjust position sizes based on market conditions

3. Debt Shifting: Move debt between different protocols for better rates

4. Portfolio Rebalancing: Maintain desired asset allocation across protocols

5. Risk Management: Monitor and adjust positions to maintain desired risk levels

6. Yield Optimization: Maximize returns by managing positions across different protocols

7. Emergency Response: Quick reaction to market volatility through automation

8. Complex DeFi Strategies: Implementation of sophisticated DeFi trading and lending strategies

Common Questions

1. How secure is DeFi Saver?

DeFi Saver uses audited smart contracts and non-custodial architecture for security.

2. What are the costs involved?

Users pay gas fees for transactions and a small fee for automation services.

3. Which networks are supported?

Primarily operates on Ethereum mainnet.

4. How does automation work?

Automation is handled through smart contracts that monitor and execute predefined conditions.

5. Is it suitable for beginners?

Better suited for users with DeFi experience due to complexity.

6. What happens if automation fails?

Multiple backup systems and monitoring tools are in place to ensure reliability.