Uniswap - Decentralized Crypto Trading & Liquidity Pools

Decentralized crypto exchange with automated token swaps and liquidity

Introduction

Introduction to Uniswap

Uniswap is a pioneering decentralized exchange (DEX) built on the Ethereum blockchain, operating as an automated market maker (AMM). Unlike traditional exchanges, it eliminates order books and centralized intermediaries, allowing users to trade cryptocurrencies directly from their wallets. Launched in 2018 by Hayden Adams, Uniswap has become a cornerstone of the decentralized finance (DeFi) ecosystem, facilitating trustless swaps, liquidity provision, and yield farming.

Key Features and Functionality

Uniswap’s core innovation is its AMM model, which uses liquidity pools instead of order books. Users can swap ERC-20 tokens seamlessly, with prices determined by a constant product formula (x*y=k). Liquidity providers (LPs) deposit pairs of tokens into pools, earning fees from trades. The platform supports multiple versions, with Uniswap V3 introducing concentrated liquidity for improved capital efficiency. Additionally, it integrates with Web3 wallets like MetaMask, ensuring non-custodial transactions.

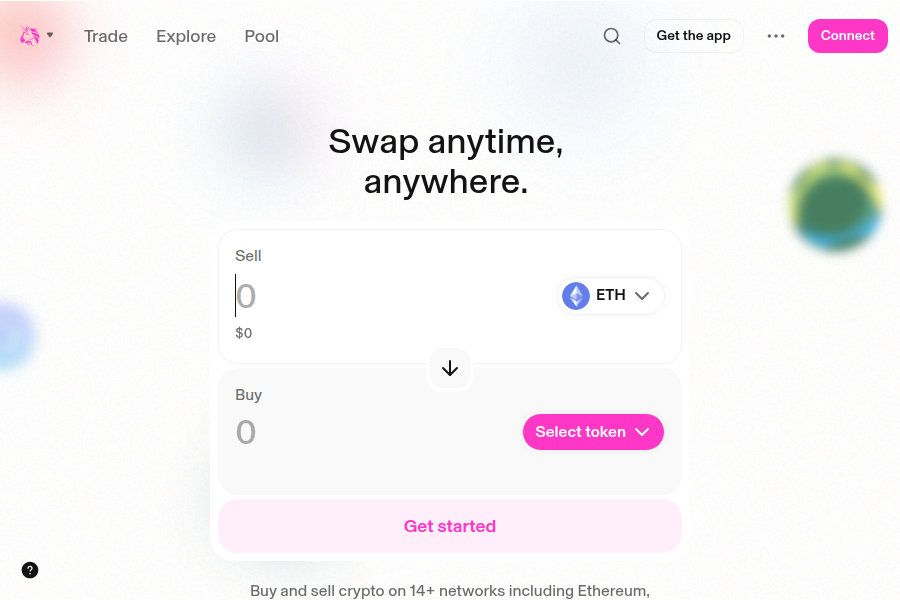

User Experience and Interface

The Uniswap app features a clean, minimalist design optimized for ease of use. The homepage focuses on token swapping, with clear inputs for assets and slippage tolerance. Advanced options, such as liquidity pool participation and NFT trading (via Uniswap Labs’ acquisition of Genie), are accessible but not overwhelming. The interface is mobile-responsive, though on-chain transactions require gas fees, which can be costly during network congestion.

Technology and Security

Uniswap runs entirely on-chain via smart contracts, audited by firms like Trail of Bits and OpenZeppelin. Its decentralized nature reduces counterparty risk, but users must manage their private keys and transaction settings (e.g., slippage) to avoid exploits. The protocol is governed by UNI token holders, who vote on upgrades and treasury management. However, as a dApp, it relies on Ethereum’s security, which has proven robust despite scalability limitations.

Market Position and Competitors

Uniswap dominates the DEX market with the highest trading volumes and liquidity depths. It competes with other AMMs like SushiSwap and Curve, but its first-mover advantage, brand recognition, and continuous innovation (e.g., V3’s concentrated liquidity) keep it ahead. Cross-chain expansions (e.g., on Polygon and Arbitrum) via the Uniswap Protocol enhance its reach, though multichain interoperability remains a work in progress.

Challenges and Criticisms

Despite its success, Uniswap faces issues like high gas fees on Ethereum L1, which deter small traders. Impermanent loss risks for LPs and regulatory uncertainty around DeFi also pose challenges. The interface does not natively aggregate rates from other DEXs, potentially leading to suboptimal swaps, though third-party aggregators address this.

Conclusion and Future Outlook

Uniswap remains the gold standard for decentralized trading, combining innovation, security, and usability. Its community-driven governance and multichain strategy position it for long-term growth, especially as Layer 2 scaling solutions reduce fees. For Web3 enthusiasts, it is an indispensable tool for accessing DeFi’s core functionalities.