Rubic Exchange - Multi-Chain DeFi Aggregator & Cross-Chain Swaps

Multi-chain DeFi aggregator for cross-chain swaps with smart routing

Introduction

Introduction to Rubic Exchange

Rubic Exchange is a decentralized multi-chain protocol designed to facilitate seamless cryptocurrency trading and cross-chain swaps. Operating as a DeFi aggregator, it integrates numerous decentralized exchanges (DEXs) and cross-chain bridges into a single interface, allowing users to trade tokens across over 70 blockchains efficiently. The platform emphasizes accessibility, security, and interoperability, aligning with core Web3 principles of decentralization and user sovereignty.

Key Features and Functionality

Rubic's primary feature is its cross-chain swap capability, which leverages bridges like Axelar and Celer to enable asset transfers between ecosystems such as Ethereum, Binance Smart Chain, Polygon, and Solana. The platform aggregates liquidity from 100+ DEXs, including Uniswap and PancakeSwap, ensuring competitive pricing and minimal slippage. Additionally, Rubic supports limit orders, instant swaps, and gasless transactions for certain operations, reducing barriers for novice users. Its non-custodial model ensures users retain control of their funds, with no mandatory KYC requirements.

Technology and Security

Built on smart contracts audited by firms like CertiK, Rubic prioritizes security while maintaining transparency. The protocol uses a combination of proprietary routing algorithms and integrated bridge protocols to optimize swap routes and costs. However, as with any cross-chain solution, risks associated with bridge vulnerabilities exist, though Rubic mitigates these through multi-bridge support and continuous monitoring.

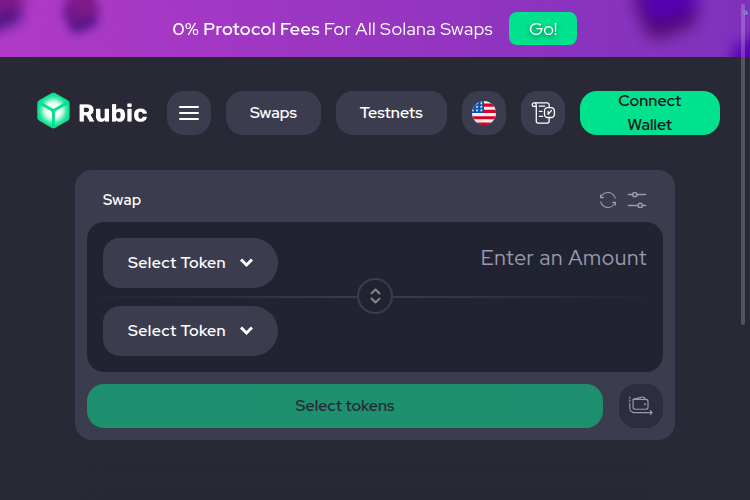

User Experience and Design

The interface is intuitive, featuring a swap-centric design similar to leading DEXs but with added chain selection options. Users can connect wallets like MetaMask or WalletConnect, select source and destination chains, and execute trades in few steps. The platform also provides real-time gas fee estimates and transaction tracking, enhancing usability.

Target Audience and Use Cases

Rubic caters to DeFi traders, cross-chain enthusiasts, and developers seeking efficient asset transfers across fragmented blockchain networks. Its aggregation model benefits users comparing rates, while cross-chain functionality supports liquidity provisioning and arbitrage opportunities. Developers can leverage Rubic's SDK for dApp integration.

Competitive Analysis

Compared to competitors like 1inch (focused on single-chain aggregation) or ThorChain (native cross-chain), Rubic distinguishes itself through broader chain support and bridge aggregation. However, it faces challenges in liquidity depth for less popular chains and requires ongoing innovation to stay ahead in the rapid-evolving Web3 space.

Conclusion and Outlook

Rubic excels as a unified gateway for multi-chain trading, addressing critical interoperability needs in Web3. Its strengths lie in extensive chain support and aggregated liquidity, though future success depends on enhancing liquidity networks, reducing reliance on third-party bridges, and expanding fiat integrations. The platform is well-positioned to grow as cross-chain demand increases.