Raydium - Decentralized Exchange on Solana

Solana DEX with AMM liquidity and order book trading

Introduction

Introduction to Raydium

Raydium is a decentralized exchange (DEX) and automated market maker (AMM) operating on the Solana blockchain. Launched to capitalize on Solana's high throughput and low transaction costs, Raydium provides users with a seamless trading experience, liquidity provisioning, and yield-earning opportunities. It stands out by integrating with Serum, a central limit order book on Solana, allowing access to broader liquidity and advanced trading features.

Key Features and Functionality

Raydium offers several core features that define its role in the Web3 ecosystem. The platform includes swap functionality for token exchanges, liquidity pools where users can deposit assets to earn fees, and farming programs that reward liquidity providers with additional tokens. Its integration with Serum enables limit orders and on-chain order book trading, which is uncommon in typical AMMs. Raydium also supports initial pool offerings (IPOs) for new projects launching on Solana, fostering innovation and token distribution.

Technology and Performance

Built on Solana, Raydium leverages the blockchain's capability to process up to 65,000 transactions per second with minimal fees. This technical foundation ensures fast trade executions and a smooth user experience, even during high network demand. The platform's smart contracts are audited and optimized for security, reducing risks like front-running and impermanent loss common in DeFi.

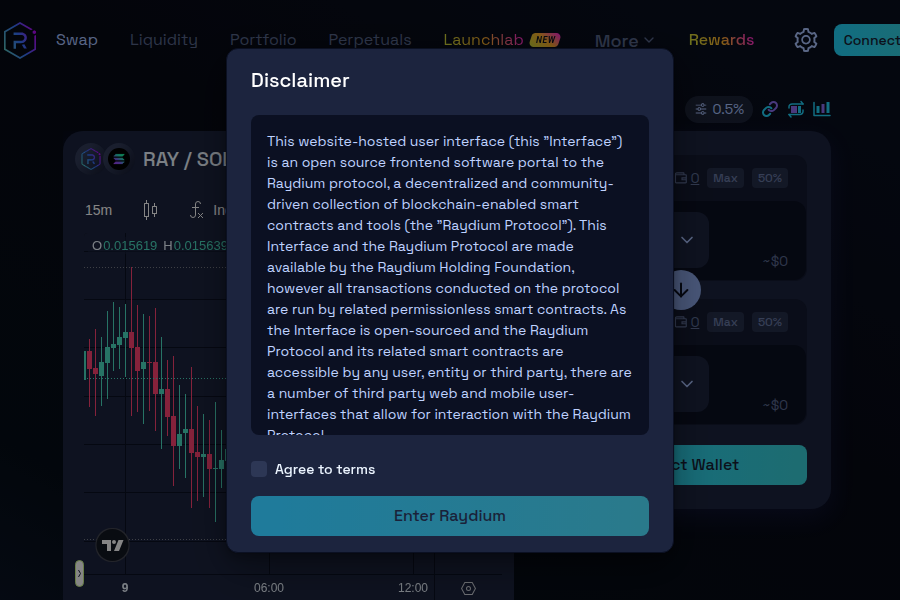

User Experience and Interface

Raydium's interface is designed for both beginners and advanced users. The swap and pool sections are intuitive, while the analytics dashboard provides detailed data on liquidity, volumes, and rewards. Mobile compatibility and wallet integration (e.g., Phantom, Solflare) enhance accessibility, making DeFi activities straightforward.

Competitive Landscape and Challenges

Raydium faces competition from other DEXs on Solana (e.g., Orca) and cross-chain platforms (e.g., Uniswap). Its reliance on Solana's network stability is a double-edged sword; while Solana offers speed, it has experienced outages, potentially affecting Raydium's reliability. However, Raydium's unique Serum integration and focus on Solana-based assets give it a strong niche advantage.

Conclusion and Future Outlook

Raydium is a pivotal DeFi protocol on Solana, driving liquidity and innovation in the ecosystem. Its blend of AMM and order book trading, coupled with high performance, makes it a preferred choice for traders and liquidity providers. Future developments may include cross-chain expansions and enhanced governance features, solidifying its position in Web3.