Matcha.xyz - Decentralized Crypto Trading Aggregator

DEX aggregator with smart order routing and optimal pricing across chains

Introduction

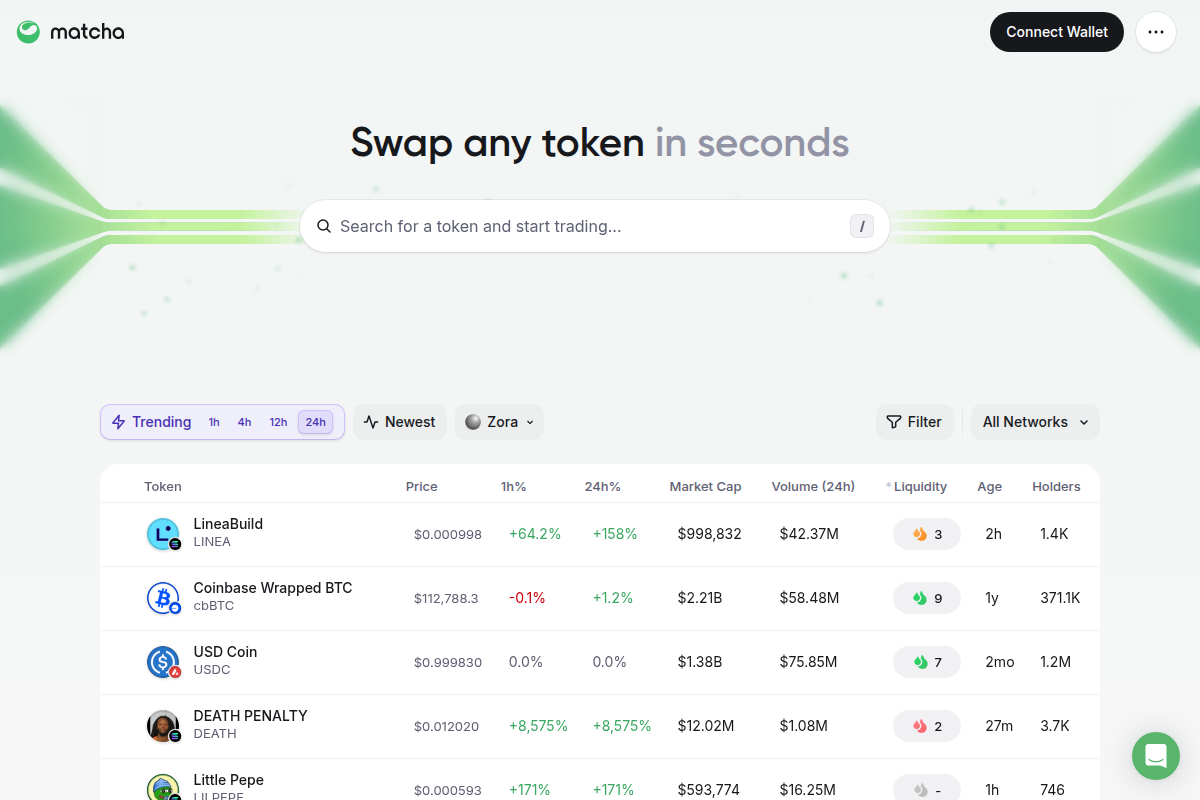

Introduction to Matcha.xyz

Matcha.xyz represents a next-generation decentralized exchange (DEX) aggregator built by the team behind 0x Protocol. Unlike traditional decentralized exchanges that operate with their own liquidity pools, Matcha scans multiple DEXs across various blockchain networks to find the best possible prices for cryptocurrency trades. This approach solves a critical problem in DeFi - fragmented liquidity across numerous trading venues.

Core Technology and Architecture

The platform's technical foundation is built on 0x Protocol's off-chain order relay combined with on-chain settlement. Matcha employs sophisticated algorithms that analyze liquidity depth, price impact, and gas costs across integrated DEXs including Uniswap, SushiSwap, Balancer, and numerous other liquidity sources. Its smart order routing technology automatically splits large orders across multiple venues to minimize slippage and optimize execution costs. The system also incorporates gas-aware routing that considers network congestion and transaction costs when determining the optimal trading path.

Multi-Chain Capabilities

Originally launched on Ethereum, Matcha has expanded to support multiple blockchain networks including Polygon, Binance Smart Chain, Avalanche, Fantom, and Optimism. This multi-chain approach allows users to access deeper liquidity pools while benefiting from lower transaction costs on alternative Layer 2 and sidechain solutions. The platform maintains consistent user experience across all supported networks with seamless chain switching functionality.

Trading Features and Tools

Matcha offers both simple swap functionality for casual traders and advanced trading features for professional users. The platform provides limit orders, gasless trading experiences through meta-transactions, and price impact warnings. Unique features like price comparison tools allow users to see how their trade would execute across different DEXs before confirming transactions. The interface also displays real-time gas estimates and incorporates MEV protection mechanisms to safeguard users from front-running attacks.

Security and User Protection

Security is paramount in Matcha's design philosophy. The platform undergoes regular smart contract audits and bug bounty programs. Unlike some aggregators that use token approval for entire wallet balances, Matcha implements precise amount approvals to minimize risk. The system includes slippage protection mechanisms and integrates with wallet security providers to detect malicious websites and potential phishing attempts.

User Experience Design

Matcha's interface prioritizes simplicity without sacrificing functionality. The clean design makes complex DeFi trading accessible to beginners while providing advanced charts and analytics for experienced traders. The platform offers educational resources within the interface, explaining concepts like slippage, gas fees, and liquidity sources to help users make informed decisions.

Liquidity Provider Integration

For liquidity providers, Matcha serves as an additional distribution channel that doesn't require separate integration. Any DEX or liquidity pool that integrates with 0x Protocol automatically becomes available through Matcha's aggregation engine. This creates a virtuous cycle where more liquidity sources improve trading outcomes, which in turn attracts more trading volume.

Competitive Landscape and Differentiation

In the competitive DEX aggregation space, Matcha distinguishes itself through its focus on price execution quality rather than simply offering the lowest apparent fees. While some competitors prioritize flashy features, Matcha concentrates on the fundamentals of trading - best execution, security, and reliability. The platform avoids native token incentives that might compromise user experience, instead focusing on organic growth through superior technology.

Future Development Trajectory

Matcha continues to expand its network support and integrate new liquidity sources. The development roadmap includes cross-chain swap capabilities, improved analytics dashboard, and enhanced institutional trading features. The team is also working on more sophisticated order types and risk management tools to cater to professional trading needs while maintaining accessibility for retail users.