LI.FI: Cross-Chain Crypto & DeFi Aggregation Protocol

Cross-chain bridge and DEX aggregator with smart routing for low-cost swaps

Introduction

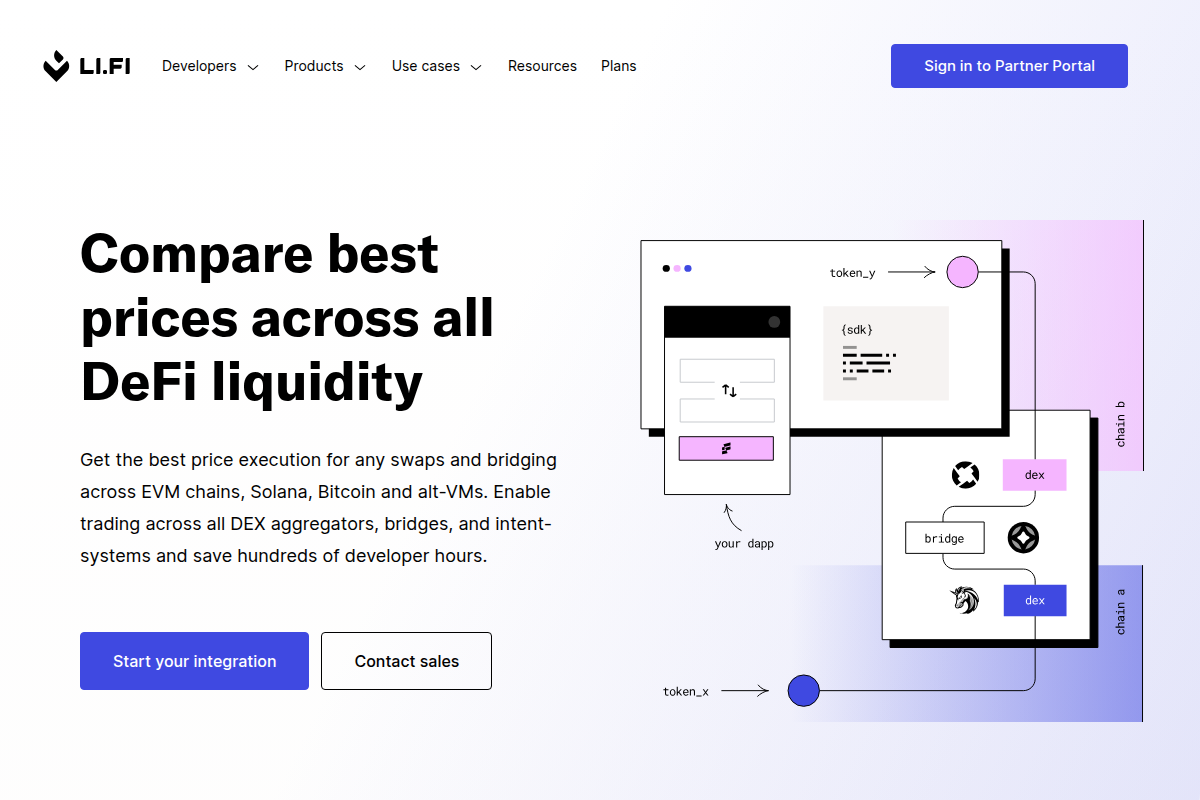

Introduction to LI.FI

LI.FI is a cross-chain aggregation protocol designed to address blockchain fragmentation by enabling seamless asset transfers and swaps across multiple networks. It serves as a critical infrastructure layer in Web3, connecting users and developers to decentralized liquidity sources through a unified interface. The platform integrates various bridges and decentralized exchanges (DEXs) to optimize routing, reduce costs, and enhance transaction security.

Core Functionality and Features

LI.FI’s primary offering is its aggregation engine, which scans 15+ bridging protocols (e.g., Connext, Hop Protocol) and 15+ DEXs (e.g., Uniswap, 1inch) to find the most efficient cross-chain routes. Users can swap tokens between chains like Ethereum, Polygon, and Arbitrum with minimal slippage and fees. For developers, LI.FI provides an SDK and API to embed cross-chain functionality into dApps, wallets, and other DeFi products. Key features include real-time liquidity tracking, fraud detection, and support for 20+ blockchains.

Target Audience and Use Cases

The platform caters to two main segments: retail DeFi users seeking hassle-free cross-chain swaps and developers building multi-chain applications. Use cases include cross-chain yield farming, NFT minting, and liquidity provisioning. LI.FI’s infrastructure is particularly valuable for projects operating in ecosystems like Ethereum L2s, EVM-compatible chains, and emerging networks.

Competitive Landscape and Differentiation

LI.FI operates in a competitive space with rivals like Socket (Bungee), Squid, and LayerZero. Its differentiation lies in its multi-bridge aggregation approach, which reduces reliance on any single bridge and mitigates risks such as outages or exploits. The protocol’s emphasis on security—via audits and monitoring tools—also stands out. However, it faces challenges in maintaining low fees as network congestion varies.

Technology and Security

Built on smart contracts and off-chain resolvers, LI.FI uses a modular architecture to integrate new bridges and DEXs quickly. Security measures include regular audits (e.g., by Quantstamp), transaction simulation, and anomaly detection. The protocol does not custody funds, relying instead on integrated bridges’ security models.

Tokenomics and Business Model

As of now, LI.FI does not have a native token. Its business model revolves from fees generated through routing transactions, though details are not fully public. Future tokenization could align with governance or fee distribution, common in Web3 protocols.

Conclusion and Outlook

LI.FI is a pivotal project in solving blockchain interoperability, offering a user-friendly and developer-centric approach. Its aggregation model enhances liquidity access and security, but success depends on sustaining integration partnerships and adapting to evolving multi-chain trends. As Web3 grows, LI.FI’s role as a cross-chain backbone could expand significantly.