Hashflow - Decentralized Trading Platform & Crypto Exchange

Zero-slippage cross-chain DEX with smart RFQ for efficient trading

Introduction

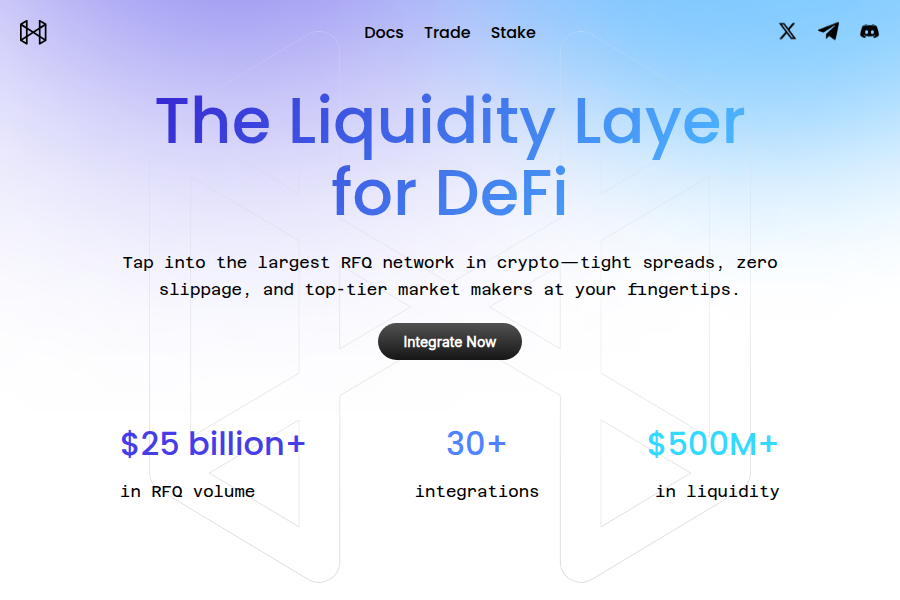

Introduction to Hashflow

Hashflow is a decentralized exchange (DEX) designed to address common limitations in traditional automated market maker (AMM) models. By leveraging a request-for-quote (RFQ) system, Hashflow connects users directly with professional market makers, enabling zero-slippage trades and protection against miner extractable value (MEV). The platform supports multiple blockchains, including Ethereum, Solana, and Polygon, facilitating seamless cross-chain swaps.

Technology and Innovation

Hashflow's core innovation lies in its RFQ engine, which allows market makers to provide firm pricing for trades. This model eliminates price slippage and impermanent loss, common issues in AMM-based DEXs. Additionally, Hashflow's cross-chain capability enables users to trade assets across different networks without wrapping tokens or using bridges, enhancing capital efficiency and user experience.

User Experience and Security

The platform offers an intuitive interface tailored for both retail and institutional traders. Features like instant trade execution, transparent fee structures, and MEV protection prioritize security and simplicity. Hashflow also employs smart contract audits and robust encryption to safeguard user funds and data.

Market Position and Competitiveness

In the crowded DeFi landscape, Hashflow competes with established DEXs like Uniswap and Sushiswap by offering superior pricing and cross-chain functionality. Its focus on institutional liquidity and user protection positions it as a bridge between traditional finance and decentralized ecosystems.

Future Prospects

Hashflow continues to expand its chain support and integrate new features, such as leveraged trading and yield products. Its roadmap emphasizes scalability and interoperability, aiming to become a comprehensive DeFi hub for cross-chain trading and beyond.