Deribit - Bitcoin and Ethereum Options and Futures Exchange

Leading crypto options and futures exchange with deep liquidity and professional tools

Introduction

Deribit stands as the undisputed leader in the cryptocurrency derivatives landscape, specifically engineered for professional and institutional traders. Founded in 2016, it has cemented its position as the world's largest exchange for Bitcoin and Ethereum options by trading volume, a testament to its deep liquidity and market dominance. The platform's core functionality revolves around providing sophisticated financial instruments that allow users to manage risk and capitalize on market movements beyond simple spot trading.

The primary products offered are options and futures contracts. Options on Deribit give traders the right, but not the obligation, to buy (call option) or sell (put option) Bitcoin or Ethereum at a specific price on or before a certain date. This is instrumental for advanced strategies like hedging existing portfolios against downside risk, generating income through covered calls, or purely speculating on market volatility. Futures contracts, including perpetual swaps that have no expiry date, allow traders to take leveraged long or short positions on the future price of the underlying assets. This is crucial for speculation, arbitrage, and hedging.

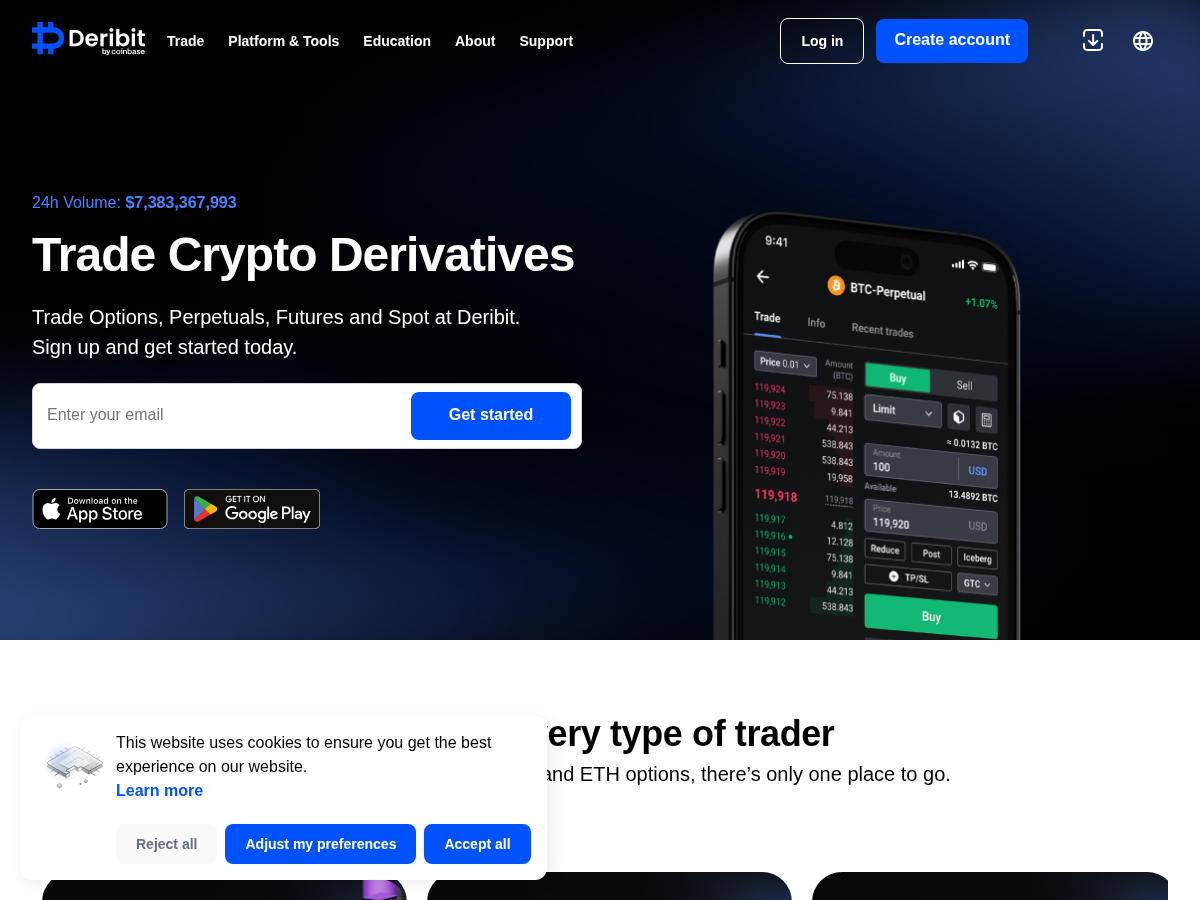

The user interface, while potentially daunting for beginners, is a powerhouse for experienced traders. It features advanced charting tools powered by TradingView, a full-featured order book, and a wide array of order types (including limit, market, stop-loss, and take-profit). The platform's API is robust and low-latency, catering to algorithmic trading firms and high-frequency traders who require programmatic access to execute complex strategies automatically. This technical excellence is a key reason for its popularity among professional trading desks.

A critical analysis of Deribit's application scenarios reveals its central role in the Web3 financial ecosystem. Firstly, it is the primary venue for institutional hedging. Large Bitcoin miners, funds, and OTC desks use Deribit's options to protect